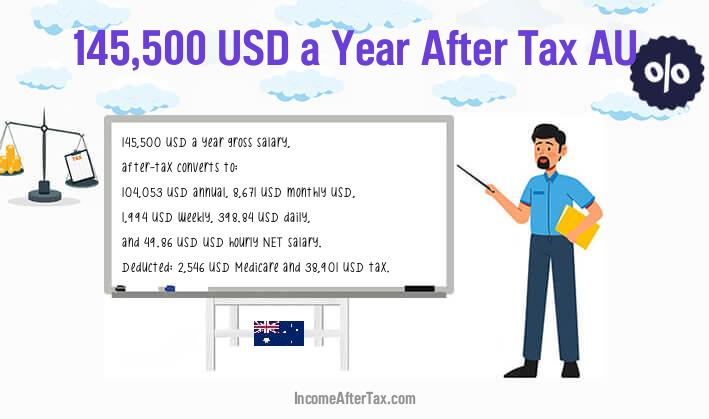

How much is $145,500 a Year After Tax in Australia?

In the year 2026, in Australia, $145,500 a year gross salary, after-tax, is $104,053 annual, $8,671 monthly, $1,994 weekly, $398.84 daily, and $49.86 hourly gross based on the information provided in the calculator above.

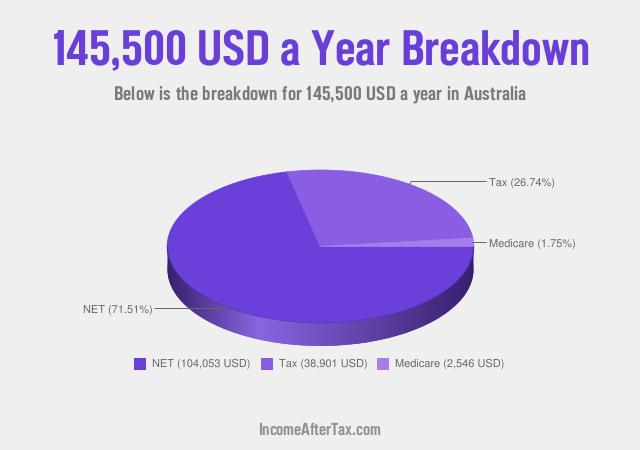

Check the table below for a breakdown of $145,500 a year after tax in Australia.

| Yearly | Monthly | Weekly | Daily | Hourly | |

|---|---|---|---|---|---|

| Gross Salary | $145,500 | $12,125 | $2,789 | $557.71 | $69.71 |

| Medicare | $2,546 | $212.17 | $48.8 | $9.76 | $1.22 |

| Tax | $38,901 | $3,242 | $745.55 | $149.11 | $18.64 |

| Personal Allowance | $18,200 Per Year | ||||

| Taxable Salary | $127,300 Per Year | ||||

| Take-Home Pay (NET) | $104,053 | $8,671 | $1,994 | $398.84 | $49.86 |

If you're interested in discovering how much you would earn a year with an extra $100 added to your annual salary, you can explore the calculations for a $145,600 annual income. This will provide you with a better understanding of the difference that additional $100 can make to your annual earnings.

$145,500 a Year is How Much a Month?

When evaluating a $145,500 a year after tax income, the corresponding monthly earnings can be determined:

- Take-home (NET) monthly income: $8,671

In order to discover $145,500 a year is how much a month? - simply divide the annual amount by 12, resulting in a monthly income of $8,671.

$145,500 a Year is How Much a Week?

When assessing a $145,500 a year after tax salary, the associated weekly earnings can be calculated:

- Take-home (NET) weekly income: $1,994

To answer $145,500 a year is how much a week? - divide the annual sum by 52, resulting in a weekly income of $1,994.

$145,500 a Year is How Much a Day?

When examining a $145,500 a year after tax income, the corresponding daily earnings can be determined:

- Take-home (NET) daily income: $398.84 (assuming a 5-day work week)

To find out $145,500 a year is how much a day? - divide the annual figure by 260 (52 weeks * 5 days), resulting in a daily income of $398.84.

$145,500 a Year is How Much an Hour?

When analyzing a $145,500 a year after-tax salary, the associated hourly earnings can be calculated:

- Take-home (NET) hourly income: $49.86 (assuming a 40-hour work week)

To answer $145,500 a year is how much an hour? - divide the annual amount by 2,080 (52 weeks * 40 hours), resulting in an hourly income of $49.86.

Is $145,500 a Year a Good Salary?

To answer if $145,500 a year is a good salary. We need to compare it to the national median. After calculation using ongoing year (2026) data, the salary of $145,500 a year is 2.69 times or 62.78% higher than the national median. So, is $145,500 a year a good salary?

Based on comparison to the national median, yes, in our opinion, it is a very good salary in Australia.

We think these three links are helpful and related to the $145,500 After Tax AU: Individual income tax rates, Tax in Australia, and Income tax in Australia.