The information and calculations on this page are based on your location (United Kingdom), assuming you are not in Scotland. It is important to note that Scottish citizens pay different tax rates, change the 'Live in Scotland?' option in the calculator above if you want to check the Scottish version of this £1,230 a day salary calculation.

How much is £1,230 a Day After Tax in the United Kingdom?

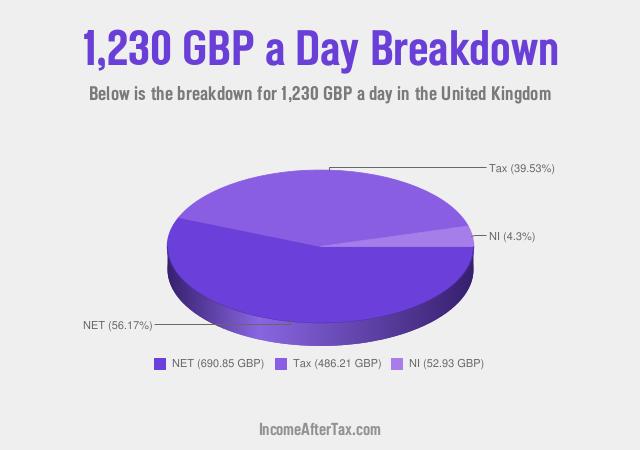

In the year 2026, in the United Kingdom, £1,230 a day gross salary, after-tax, is £180,235 annual, £15,020 monthly, £3,454 weekly, £690.85 daily, and £86.36 hourly gross based on the information provided in the calculator above.

Check the table below for a breakdown of £1,230 a day after tax in the United Kingdom.

| Yearly | Monthly | Weekly | Daily | Hourly | |

|---|---|---|---|---|---|

| Gross Salary | £320,891 | £26,741 | £6,150 | £1,230 | £153.75 |

| National Insurance (NI) | £13,810 | £1,151 | £264.67 | £52.93 | £6.62 |

| Tax | £126,847 | £10,571 | £2,431 | £486.21 | £60.78 |

| Student Loan | £0 | £0 | £0 | £0 | £0 |

| Personal Allowance | £0 Per Year | ||||

| Taxable Salary | £320,891 Per Year | ||||

| Take-Home Pay (NET) | £180,235 | £15,020 | £3,454 | £690.85 | £86.36 |

If you're interested in discovering how much you would earn a day with an extra £10 added to your daily salary, you can explore the calculations for a £1,240 daily income. This will provide you with a better understanding of the difference that additional £10 can make to your daily earnings.

£1,230 a Day is How Much a Year?

£1,230 a day breaks down to the following yearly salary:

- Gross (pre-tax) yearly wage of £320,891

- Take-home (NET) yearly income of £180,235

£1,230 a Day is How Much a Month?

When evaluating a £1,230 a day after tax income, the corresponding monthly earnings can be determined:

- Take-home (NET) monthly income: £15,020

In order to discover £1,230 a day is how much a month? - simply divide the annual amount by 12, resulting in a monthly income of £15,020.

£1,230 a Day is How Much a Week?

When assessing a £1,230 a day after tax salary, the associated weekly earnings can be calculated:

- Take-home (NET) weekly income: £3,454

To answer £1,230 a day is how much a week? - divide the annual sum by 52, resulting in a weekly income of £3,454.

£1,230 a Day is How Much an Hour?

When analyzing a £1,230 a day after-tax salary, the associated hourly earnings can be calculated:

- Take-home (NET) hourly income: £86.36 (assuming a 40-hour work week)

To answer £1,230 a day is how much an hour? - divide the annual amount by 2,080 (52 weeks * 40 hours), resulting in an hourly income of £86.36.

Is £1,230 a Day a Good Salary?

To answer if £1,230 a day is a good salary. We need to compare it to the national median. After calculation using ongoing year (2026) data, the salary of £1,230 a day is 8.42 times or 88.12% higher than the national median. So, is £1,230 a day a good salary?

Based on comparison to the national median, yes, in our opinion, it is a very good salary in the United Kingdom.

We think these three links are helpful and related to the £1,230 a Day After Tax UK: Income Tax rates and Personal Allowances, Income Tax, and Taxation in the United Kingdom.