How much is $106,900 a Year After Tax in Australia?

In the year 2026, in Australia, $106,900 a year gross salary, after-tax, is $79,917 annual, $6,660 monthly, $1,532 weekly, $306.33 daily, and $38.29 hourly gross based on the information provided in the calculator above.

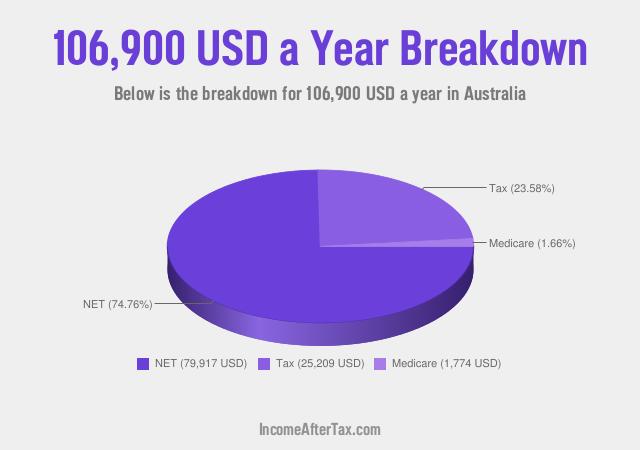

Check the table below for a breakdown of $106,900 a year after tax in Australia.

| Yearly | Monthly | Weekly | Daily | Hourly | |

|---|---|---|---|---|---|

| Gross Salary | $106,900 | $8,908 | $2,049 | $409.76 | $51.22 |

| Medicare | $1,774 | $147.83 | $34 | $6.8 | $0.85 |

| Tax | $25,209 | $2,101 | $483.14 | $96.63 | $12.08 |

| Personal Allowance | $18,200 Per Year | ||||

| Taxable Salary | $88,700 Per Year | ||||

| Take-Home Pay (NET) | $79,917 | $6,660 | $1,532 | $306.33 | $38.29 |

If you're interested in discovering how much you would earn a year with an extra $100 added to your annual salary, you can explore the calculations for a $107,000 annual income. This will provide you with a better understanding of the difference that additional $100 can make to your annual earnings.

$106,900 a Year is How Much a Month?

When evaluating a $106,900 a year after tax income, the corresponding monthly earnings can be determined:

- Take-home (NET) monthly income: $6,660

In order to discover $106,900 a year is how much a month? - simply divide the annual amount by 12, resulting in a monthly income of $6,660.

$106,900 a Year is How Much a Week?

When assessing a $106,900 a year after tax salary, the associated weekly earnings can be calculated:

- Take-home (NET) weekly income: $1,532

To answer $106,900 a year is how much a week? - divide the annual sum by 52, resulting in a weekly income of $1,532.

$106,900 a Year is How Much a Day?

When examining a $106,900 a year after tax income, the corresponding daily earnings can be determined:

- Take-home (NET) daily income: $306.33 (assuming a 5-day work week)

To find out $106,900 a year is how much a day? - divide the annual figure by 260 (52 weeks * 5 days), resulting in a daily income of $306.33.

$106,900 a Year is How Much an Hour?

When analyzing a $106,900 a year after-tax salary, the associated hourly earnings can be calculated:

- Take-home (NET) hourly income: $38.29 (assuming a 40-hour work week)

To answer $106,900 a year is how much an hour? - divide the annual amount by 2,080 (52 weeks * 40 hours), resulting in an hourly income of $38.29.

Is $106,900 a Year a Good Salary?

To answer if $106,900 a year is a good salary. We need to compare it to the national median. After calculation using ongoing year (2026) data, the salary of $106,900 a year is 1.97 times or 49.33% higher than the national median. So, is $106,900 a year a good salary?

Based on comparison to the national median, yes, in our opinion, it is a very good salary in Australia.

We think these three links are helpful and related to the $106,900 After Tax AU: Individual income tax rates, Tax in Australia, and Income tax in Australia.